Special Situations Group is now Graph Advisors. We provide fractional CFO and COO services to GPs and funds, support emerging managers raising their first fund, develop and launch new offerings, products, and strategic initiatives for funds deploying from Fund I+ with the ambition to build an enduring firm.

We made this change to build on the foundation of resources and tools for allocators, consulting and services for investors, and putting out first principles thinking about the VC space. We are excited to share more and welcome you on our journey.

Caught our attention 👀

1️⃣ Carta’s Take on Fractional CFOs for Funds

Earlier this month, Carta hosted a session with Moxxie Ventures to discuss pairing the use of software to manage fund financials with Fractional CFOs who maximize the value of the software for the benefit of the fund while protecting a GP’s time. Carta’s CEO jumped in as well to share his point of view on this growing trend in the market. You can watch the conversation here. We had three takeaways:

Just because a GP can manage fund financial operations, doesn’t mean that’s the best use of the GP’s time.

Funds win when GPs are increasingly spending time doing the things only they can do. Everything else is beta — the tasks, projects, bodies of work that that can be replaced without a meaningful deviation from the market norm.

GPs can never delegate away the oversight responsibility they have for the accuracy and integrity of the fund’s financials. A great CFO / Fractional CFO will make the oversight function more streamlined and efficient to maximize the GP’s time.

At the end of the day, long-term performance across multiple funds rests on sound operational excellence across every aspect of the firm. GPs aren’t hired by LPs because they are great operators — they are hired by LPs because they are great investors who surround themselves with great operational teams.

Resources from Graph Advisors

Thanks to everyone who has downloaded the tools we have been building for GPs and Funds. We’ve received great feedback, and thinking about charging for these helpful tools, but for now they remain free.

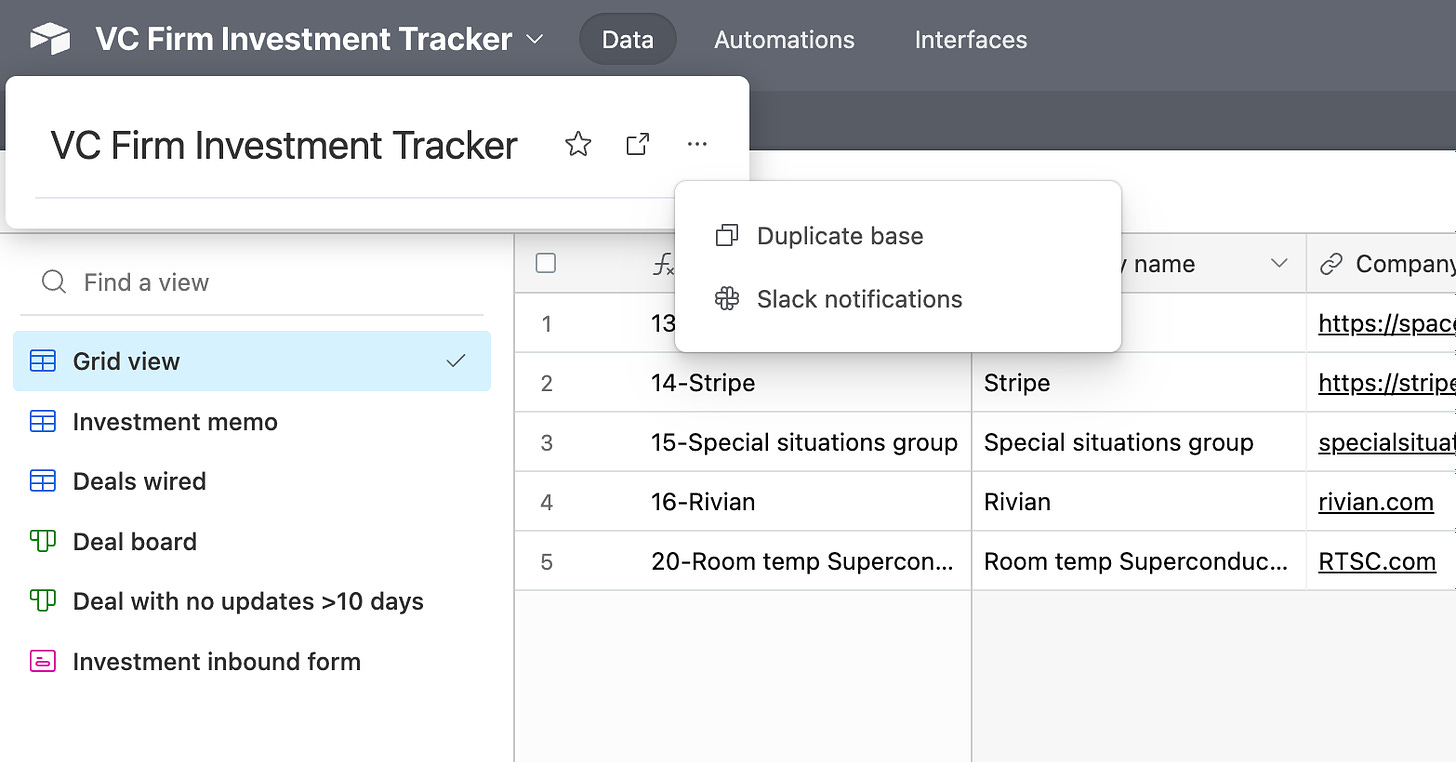

Airtable template and interface for tracking deals, writing investment memos, and coordinating with your back office team.

Data room checklists for Fund I & Fund II+.

How can I be helpful?

But seriously, let us know what you want to see next. Tools? Automations? Templates? What does your firm need next?

Upcoming Sessions

We looking forward to joining Transact Global on October 23rd to lead a session on Operational Excellence for GPs and Funds in the Transact community.

Thank you!

Please forward this newsletter to allocators you know and get in touch as you build your operating muscle. Here’s to a great October!

P.S.

Graph Advisors was featured in Sydecar’s monthly update, Sydeletter, to discuss the central role fund operations plays in driving fund performance over time. Subscribe here and read the post below.

Invest in operations now, reap the benefits later

My name is Eric Friedman, founder of Graph Advisors. I started Graph Advisors with one mission in mind: to help emerging managers, VCs, LPs, and other capital allocators navigate the intricate maze of unique operational challenges they face. While the significance of operations is universally acknowledged, professionals rarely take the time to strategically evaluate and optimize their operational framework.

Operations is a critical foundation of any allocator practice, whether you are an emerging manager deploying capital into startups for the first time, a seasoned family office running SPVs and follow-on financings, or an established VC firm with $500M+ AUM. Each brick you lay in your operational foundation today will provide the fortitude and payoff with all parties later. From team members, limited partners, founders, and service providers - the work you put in today will have an impact for years to come.

The good news is that you can start to build this operational muscle today to enable swifter, more decisive actions tomorrow. In the dynamic realm of venture capital, precision and efficiency often define the thin line between success and missed opportunities.

Doing more of what you are good at (or, the true cost of DIY ops)

Every investor has their own unique strengths, but we’ve found one thing in common with the allocators we have worked with: they all want to get back to investing and helping their portfolios. In most cases, it’s not possible to set up a strong operational foundation while also giving your companies the support they need. Emerging VCs and family offices might be tempted to manage operations and administration in-house or juggle multiple service providers; however, the complexity, time, and risk of missteps can significantly outweigh the perceived cost savings. When it comes time to wrangle service providers, many are left with a big problem and an expiring timeline to solve this challenge.

Reputation is built on trust and respect

In order to win trust and build a legacy investment practice, sound decision-making, capital preservation, and capital growth must be coupled with operational excellence. Particularly in an unpredictable fundraising environment, establishing trust with LPs is paramount. Demonstrating meticulous operations not only builds immediate confidence, but also paves the way for collaboration with institutional LPs in the future. A well-oiled operational machine serves as tangible evidence of a firm's reliability and foresight.

The power and payoff of expertise

Outsourcing operations and administration to specialized experts brings the advantage of refined expertise and a bird's-eye view of best practices across the industry. It also lets you lean into your strengths and better understand your weaknesses. If you have the operational abilities to set up, execute, and run the small business of a fund, great. If not, then outsourcing is likely in your firm’s best interest.

Beyond the obvious benefit of free time and mental bandwidth, streamlined operations directly contribute to the overall health of your firm. Whether it's more informed investment decisions, timely reporting, or enhancing LP engagement, the positive ripple effects are manifold. Setting up a strong operational foundation isn't just about doing things right, but about setting the stage for future growth, adaptability, and trust-building. It's not a journey you need to embark upon alone.

At Graph Advisors, we're committed to assisting you in this endeavor. And to demonstrate our dedication to the cause, here's a little something to help you get started.