Operational Excellence for VCs and Investors

A well-oiled operational machine serves as tangible evidence of a firm's reliability and foresight.

My name is Eric Friedman, and I founded Special Situations to assist emerging managers, VCs, LPs, and allocators in navigating the intricate maze of operational challenges.

You were added to this inaugural newsletter as we have interacted in the past, and my hope is that you will join us for a monthly mailing to hear more about fund ops, venture insights, firm structure updates, and more. Obviously if you don’t want to receive them in the future you can unsubscribe.

The significance of fund operations is universally acknowledged, but it's a rarity for fund managers to find the time and space to strategically evaluate and optimize their operational framework.

Special Situations is about the long game. Build today to enable better decisions tomorrow.

Value first - a free resource for VCs and allocators

Rather than try to convince you with words, I’m excited to share a tool with you, free of cost, that can be the lynchpin of building a strong operational foundation. Its called the VC Firm Investment Tracker and its available (for free!) in Airtable to create a copy and use/edit/create on your own. Whether you are a one person angel or syndicate allocator or a large firm with a partner/pipeline process this is a tool for you.

What it does:

Tracks each inbound and outbound investment opportunity

Asks key diligence questions and stores answers

Coordinates the investment team to review and decide with velocity

Sets up your back office and fund admin teams to execute async

Creates the ready-made snapshot you’ll need for your next LP update

Lays the foundation for a great data room to raise your next fund

Why it matters:

Never miss a deal because you dropped a ball from your inbox

Alignment internally reduces error, builds trust, and creates long-term learning

A reputation with founders for being transparent, responsive, predictable, and fair

Reduces the likelihood of hindsight bias when examining performance over long cycles

Demonstrates you invest with a test and refined process that’s your own rather than crowd-following

Micro Funds Are Dead; Long Live Micro Funds

In our conversations with fund managers and LPs, we have come across a theme where first time funds are fully deployed but the fund managers are not raising another fund.

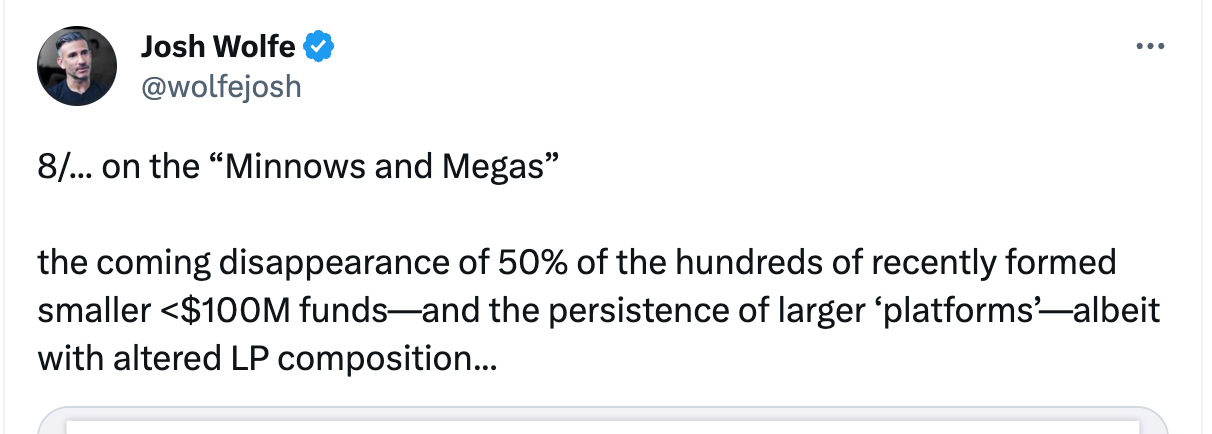

In fact, Josh Wolfe, the GP of Luxe Capital wrote a piece before the pandemic coining the concept of the Minnows and the Megas.

The idea that smaller funds would slowly fade from the marketplace has stuck with me, even keeping me up at night. The past year has proven tough for small funds, and it’s hard to see a sharp bounce back over the next 12-18 months.

To support allocators in this position, I wrote a piece on the scenarios and the choices GPs can make now to avoid the painful “Zombie” label.

Special Situations Group

I’m proud to share what I’ve been building with Special Situations Group.

Allocators are positioned at the intersection of deal flow and deployable capital. Their funds have the potential to become great, enduring businesses. But, every minute spent on the “business” side of the fund is a minute not spent sourcing deals, supporting portfolio companies, and deepening relationships with LPs.

SSG is the team for GPs that:

Are setting up their first fund and need the know-how to move quickly toward the first close

Are growing from a fund —> a firm and need to organize themselves for the additional diligence of institutional LPs

Are managing fully deployed funds and need an agent to manage the week-to-week business of the fund through distributions and final wind down.

Have a special situation that needs to be handled, e.g. migrating SPVs, executing transfers with LPs to secondary buyers, managing an end of life asset, migrating fund structures

Additionally, we have worked with select Family Offices and Large Corporations that are looking to grow their exposure to the venture asset class by building out strategies for fund of fund investing and corporate accelerator programs.

If you are encountering a special situation for your fund or just want to talk fund operations so you can get the most from your legal and fund admin teams, contact me at eric@specialsituations.co.

Special Thanks to Women In VC

Earlier this month, Special Situations Group ran a session on operational excellence for The Women in VC, hosted by Sutian Dong. It was a great discussion on the nuts and bolts of data rooms, LPACs, weekly administrative work blocks, LP updates and protecting founder confidentiality. Many thanks to the team for welcoming us.

Three things stood out from our time:

Validation that the business of the fund can often be put on the back burner even by the strongest of operators

Keeping it simple and starting with basic tools always better than the blank page

At the end of the day, the choice is between butt-in-seat admin work blocks by you or delegating admin to trusted staff or partners

Recent Reads

Private Fund regulations and the SEC