Micro Funds are Dead. Long live Micro Funds (don’t become a zombie).

Don’t be last one to recognize you are running a zombie fund.

Micro fund? Fine. Solo GP fund? Sure. Operator Investor? No problem. Specialist fund? Okay. Zombie fund? About as bad as dumb money.

And yet, the reality of a ZIRP-to-post-ZIRP cycle has many GPs of funds veering precariously close to the Zombie zone. A walking dead manager of unsupported founders with no line of sight to follow-on capital or stewardship of Limited Partners.

Early warning signs of a zombie fund manager:

Your fund is deployed or on pace to be deployed soon

Through secondary transactions your LPs are increasingly people and firms you don’t know

Your fund returns are still in the downward bend of the J-Curve, making it damn near impossible to raise your next fund

You’re starting to spend time daydreaming about what it might be like to own a “cash flow positive” small business

The management fees are enough to pay the bills but the fun is gone

In this environment, these signs aren’t that uncommon and like any good diagnosis they provide information that can be acted on before joining the ranks of the walking dead.

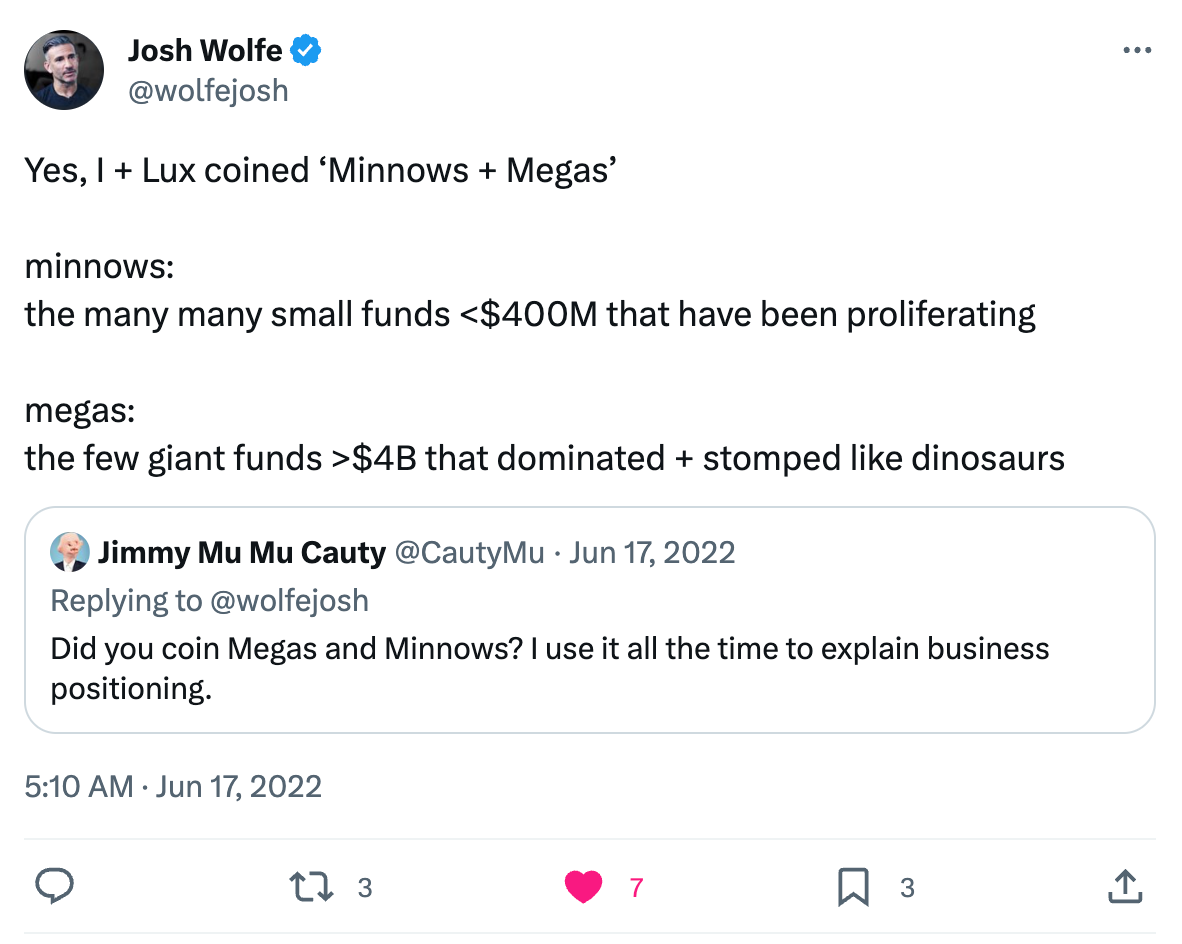

Three scenarios for the Minnows:

Through our work at Special Situations Group, we’re seeing this group of GPs consider three possible scenarios:

Scenario 1: Keep fighting

Scenario 2: Sell and move on

Scenario 3: Hire an agent

Each scenario has its trade-offs but the biggest risk is delaying action.

Let’s play it out a bit:

Scenario 1: Keep fighting

Be relentlessly helpful to your LPs and Founders. Communicate frequently, clearly, and concisely.

Be brutally honest about the successes and failures of your thesis and what you’re improving over the next quarter.

Risks:

The losses pile up and you find out you can’t handle it mentally/psychologically

The economy goes into a full blown recession. What was a tech winter becomes a tech polar vortex and you’re stuck.

Scenario 2: Sell and move on

You have some winners in the portfolio and you know what your LPs got on the secondary market.

The economy is strong (for now) and there is cash for venture – it’s just moved to different parts of the market.

Liquidity events got pushed out by several years and what is lost in future cash value is made up for in present cash value (minus years of administrative headache).

Risks

Selling out feels like quitting.

Your winners turn out to be generational winners.

The founders in your portfolio are some of the most inspiring people you know, and they would likely stop returning your texts if you were no longer on their cap table.

Scenario 3: Hire an agent

Just because you own the asset doesn’t mean you need to manage day-to-day operations. You can find a manager, set expectations, align incentives, verify quality and consistency of work product, and still remain the principal.

You get to do what you have loved doing all along – working with founders – without fussing with what you tolerated – everything else.

Between management fees and carry compensation, there’s plenty of wiggle room to retain a high quality manager.

Plus, that cash flow positive business idea doesn’t just have to be an idea. You would have time to invest in additive entrepreneurial projects that you would own fully.

Risks

Cuts into cash compensation via management fees.

Sourcing and selecting a high-quality agent.

Time and energy spent finding an agent that is trustworthy and you connect with.

Onboarding and finding if it’s a long-term fit.

A final word on timing

Experts get the timing of recessions wrong all the time and they were wrong again in 2023. We’re not experts.

We do know that for any time spent forecasting what might happen if things pick back up in tech as an effect of a soft landing, we are spending time planning for what might happen in the event of a hard landing or a sustained higher-rates-for-longer period.

GPs fighting to survive post-ZIRP would be well-served developing a point of view on what moves they will make in any one of the possible futures and what doors will be closed then that are still open today.

Fate won’t create your reality as a GP. Your choices will.

You don’t have to make this decision alone. If this sounds like you, or someone you know reach out to special situations, or, email us at hello [at] specialsituations [dot] co